income tax rate philippines 2021

8 Income Tax on Gross SalesReceipts and Other Non-Operating Income in Lieu of the Graduated Income Tax Rates and the Percentage Tax. For the year 2021 and 2022 the following tax rate shall apply for annual income tax for taxpayers defined under RA.

Korea Tax Income Taxes In Korea Tax Foundation

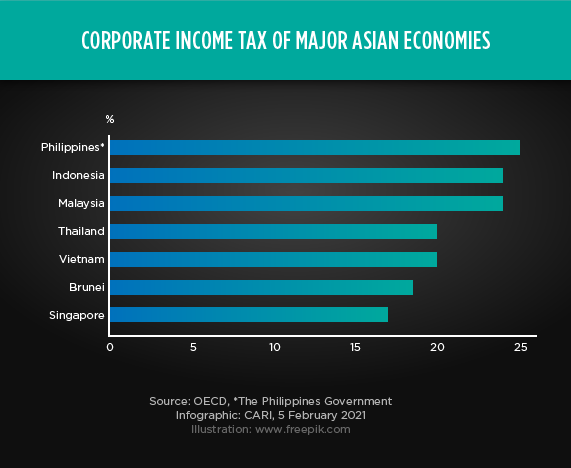

Tax rate Income tax in general 25.

/income-tax-4097292_1920-bef7c6ff9f2d4b0ab45f354ad31f1ee6.jpg)

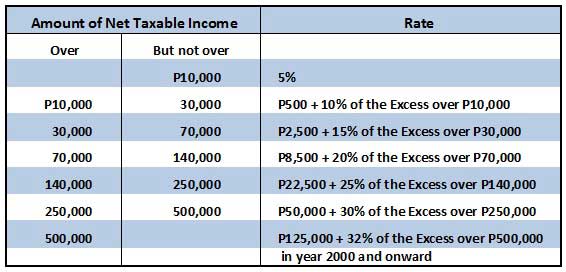

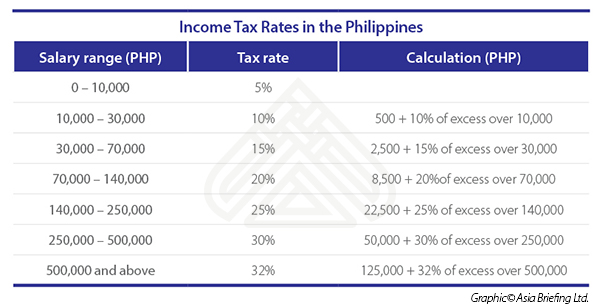

. Tax rates for income subject to final tax For resident and non-resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to final. We simplified the table to guide taxpayers easily. Income Tax Based on Graduated.

Interest on foreign loans. Personal Income Tax Rate in Philippines remained unchanged at 35 in 2021. Dividends from domestic corporationsif the country in which the.

Data published Yearly by Bureau of. The Income tax rates and personal allowances in Philippines are updated annually with new tax tables published for Resident and Non-resident taxpayers. The Philippines applies a tax arbitrage rule on deductible interest that reduces the allowable deduction for interest expenses by 20 of the interest income subject to final tax.

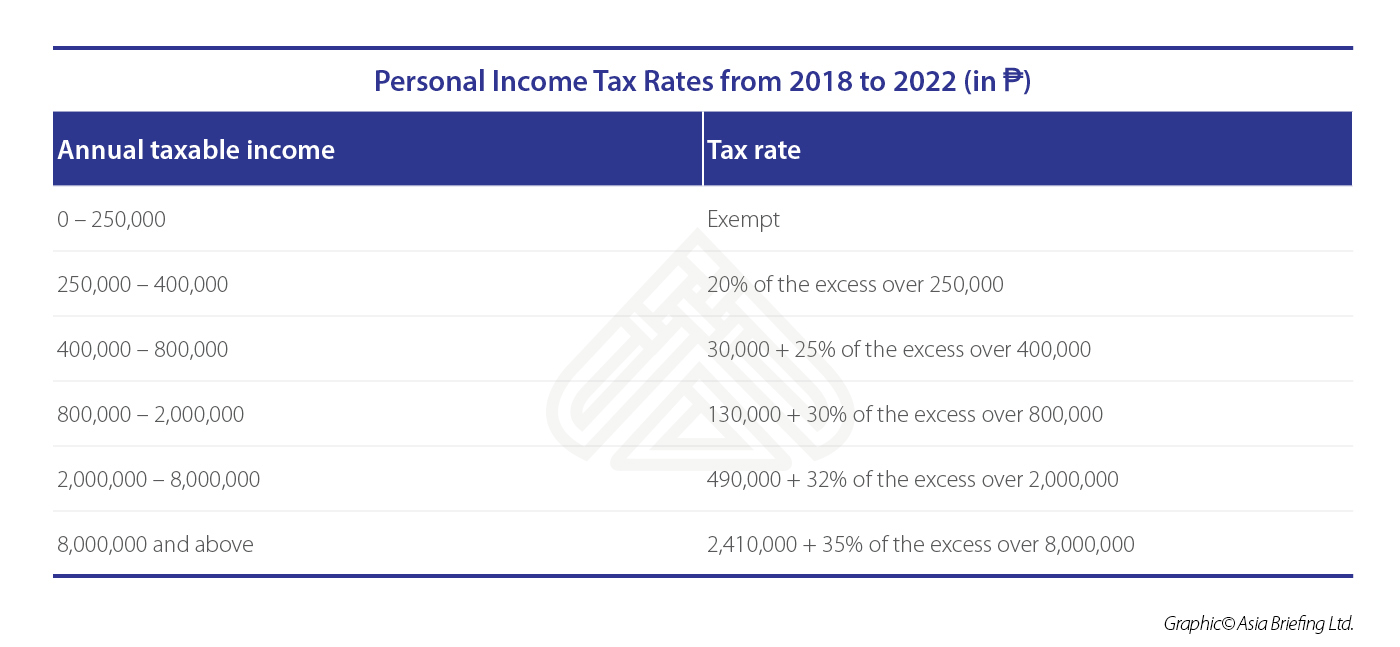

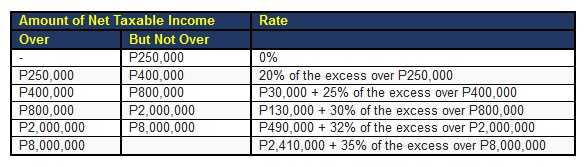

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. For Purely Self-Employed Individuals andor Professionals Whose Gross SalesReceipts and Other Non-Operating Income Do Not Exceed the VAT Threshold of P3000000 the tax shall be at the. The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income.

The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more. The top marginal income tax rate of 37 percent will. This income tax calculator can help estimate your average income.

Philippines Highlights 2021. The Tax tables below include the tax. Up to PHP 250000 0 PHP 250001 PHP 400000 20.

Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions. Philippines Income Tax Rates and Personal Allowances in 2021 The Income tax rates and personal allowances in Philippines are updated annually with new tax tables published for. 35 rows April 8 2021.

Individual income tax rate Taxable income Rate. Compliance for corporations. 25 for all other domestic corporations and resident foreign corporations eg branches Effective 1 January 2021 the CIT rate is reduced from 30 to 25 for nonresident.

Philippines Income Tax Rates and Personal Allowances in 2023 The Income tax rates and personal allowances in Philippines are updated annually with new tax tables published for. The maximum rate was 35 and minimum was 32.

The Philippines New Tax Reform Package Approved Asean Business News

Corporate Tax Rates Around The World Tax Foundation

What Are The Income Tax Rates In The Philippines For Individuals Business Tips Philippines

Income Tax Rates In The Philippines Asean Business News

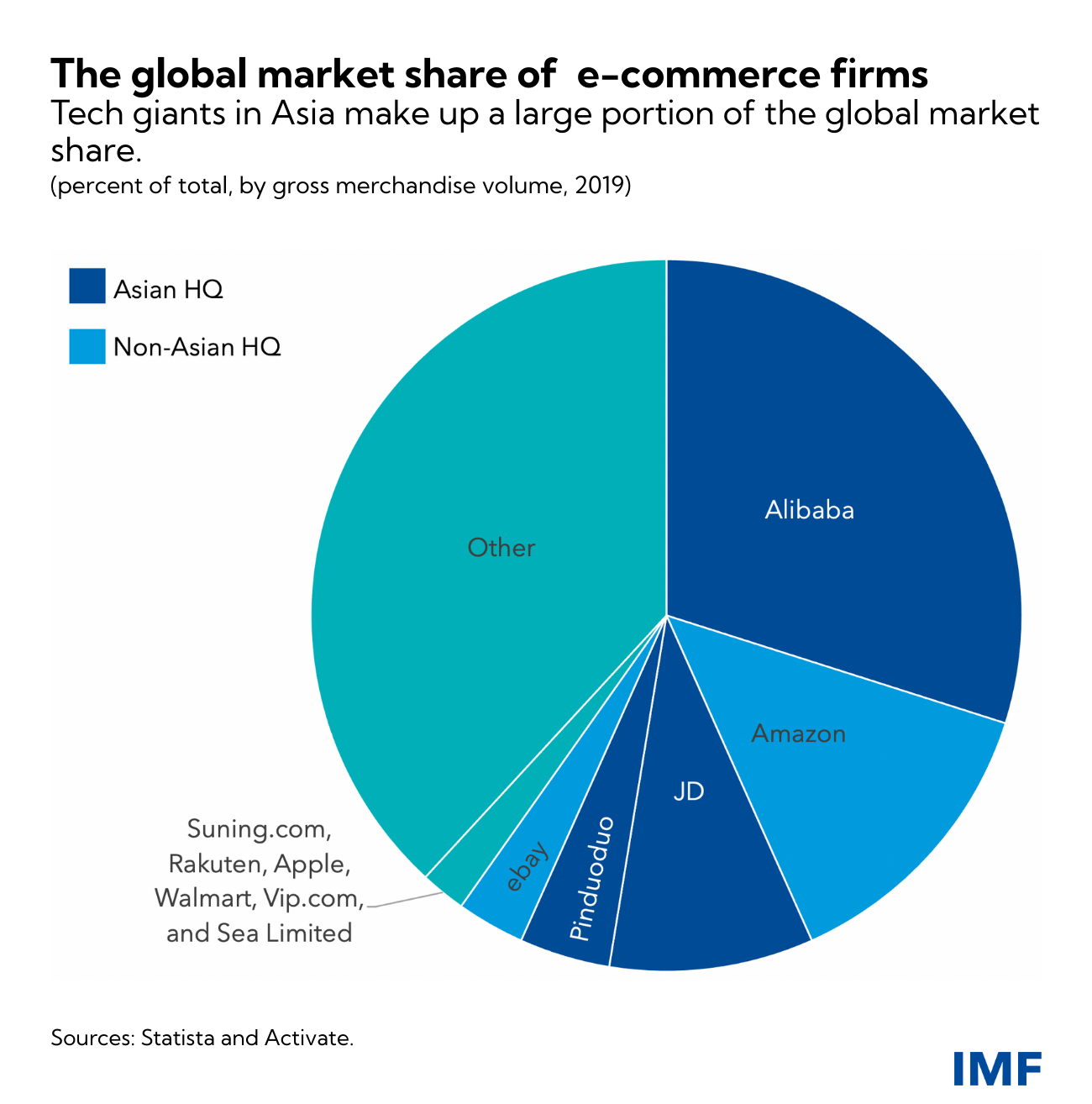

How To Tax In Asia S Digital Age

Cari Captures Issue 489 The Philippines To Cut Corporate Tax Rate To 25 For Big Companies To Aid Covid 19 Recovery Cari Asean Research And Advocacy

Corporate Tax Rates Around The World Tax Foundation

What Is The Difference Between The Statutory And Effective Tax Rate

Tax Calculator Compute Your New Income Tax

Tax Calculator Philippines 2022

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Bureau Of Internal Revenue Philippines Revenue Regulations No 5 2021 Implements The New Income Tax Rates On The Regular Income Of Corporations On Certain Passive Incomes Including Additional Allowable Deductions From Gross

Corporate Income Tax In The Philippines Youtube

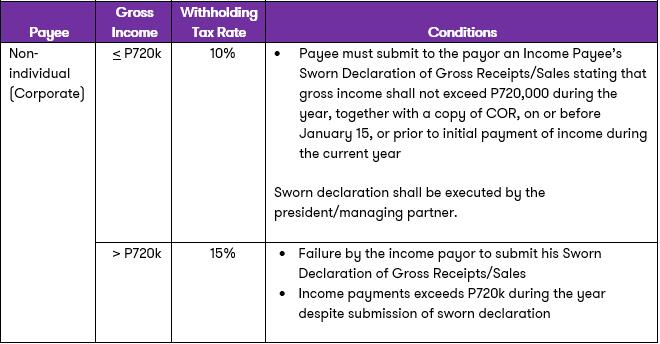

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

Corporation Tax Europe 2021 Statista

Income Tax Law Under Train Law And New Rates In The Philippines